Финансовые технологии

The minimum investment for a hedge fund can vary significantly based on several factors, including the fund’s structure, strategy, and regulatory requirements. Generally, hedge funds cater to accredited investors, which typically include high-net-worth individuals, institutional investors, and family offices https://histor-ru.ru/wp-content/pgs/chto-takoie-ts-upis-v-biet-bum-prostymi-slovami.html. As a result, the minimum investment amounts can be substantial, often ranging from $100,000 to several million dollars.

Safran is a French aircraft manufacturer whose engines are used in aircraft built by Airbus and Boeing. Aviation is one of the most closely regulated industries, and all parts and suppliers used there must pass tests by numerous authorities.

2. Expense Ratios and Fees: Every ETF comes with an expense ratio, which is the annual fee that covers the operational costs of the fund. It’s expressed as a percentage of the fund’s average assets over the year. For example, an ETF with an expense ratio of 0.10% means that for every $1,000 invested, the investor will pay $1 annually in fees. Small investors should seek out etfs with low expense ratios to maximize their returns.

4. Dividend Reinvestment: Some ETFs offer dividend reinvestment plans (DRIPs), which automatically use dividends paid out by the fund to purchase additional shares. This is a powerful tool for small investors, as it compounds growth over time without requiring additional capital.

2. Subsequent Investments: After the initial purchase, funds may have different requirements for additional investments. Some funds allow additional purchases at any amount, while others set a minimum for subsequent investments, which can be as low as $50.

Bonuses for registration and deposits

Collecting welcome bonuses at online casinos is easy to do. Typically, they only require players to create an account and make their first deposit. However, winning from the bonus and actually withdrawing a profit is a slightly more challenging task.

A welcome bonus is worth it if it’s given away by a legit online casino and it comes with fair wagering requirements and overall lenient rules. Some bonuses with heftier rules may also be worth your time and money, but your safe choice will always be to claim a bonus that comes with fair terms and conditions all around.

Claiming online casino sign up bonuses is a fantastic way to start your journey at a new casino. As indicated above, these bonuses can come in many forms, such as first deposit or no deposit bonuses. If you are thinking of claiming a casino welcome bonus, you’re best off starting with any of the offers included in our list. We’ve compiled a set of fully regulated casinos, offering the biggest and best welcome bonuses with fair terms and excellent game collections. Which one will you choose?

Collecting welcome bonuses at online casinos is easy to do. Typically, they only require players to create an account and make their first deposit. However, winning from the bonus and actually withdrawing a profit is a slightly more challenging task.

A welcome bonus is worth it if it’s given away by a legit online casino and it comes with fair wagering requirements and overall lenient rules. Some bonuses with heftier rules may also be worth your time and money, but your safe choice will always be to claim a bonus that comes with fair terms and conditions all around.

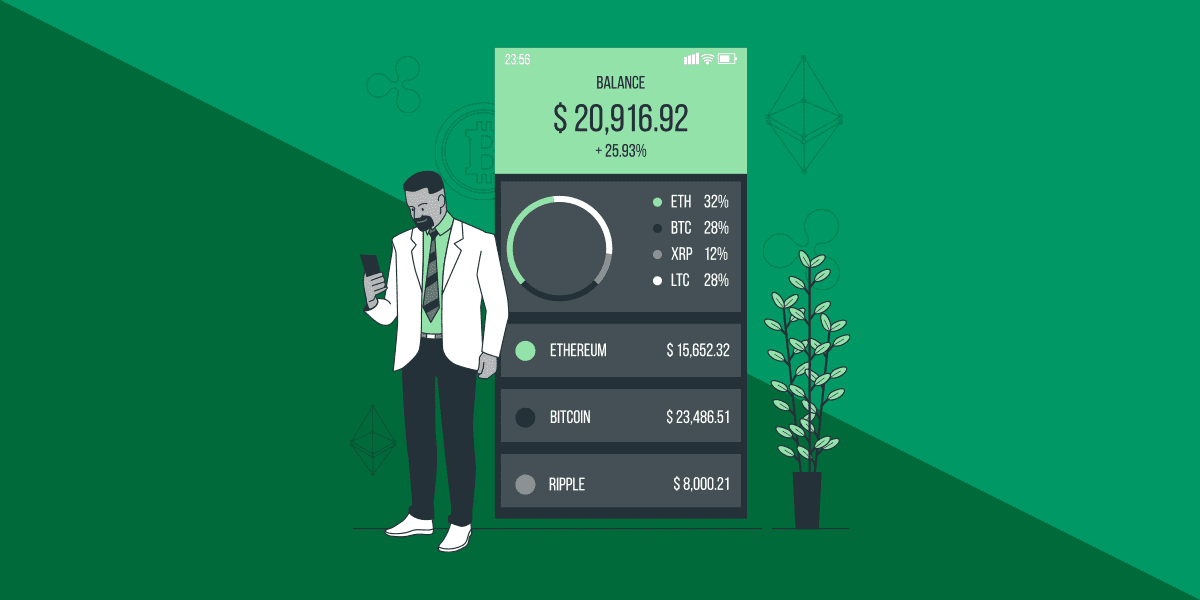

Investments in digital assets

As digital asset exchanges are usually opened 24/7, direct holding has the advantage of offering better reactivity in case of market movements, allowing the initiation of transactions at all times. For example, this also provides the possibility to set stop-loss orders triggering to sell the position in case of falling prices. Depending on the token and the exchange, the liquidity can be quite good. If the custody is performed by a bank, a securities firm, or a DLT trading infrastructure, the investor may expect an institutional-grade infrastructure that avoids operational risks to a minimum.

The blind survey was executed in association with Fidelity Consulting Strategic Insights on behalf of Fidelity Digital AssetsSM and the Fidelity Center for Applied TechnologySM between May 30, 2023 and October 6, 2023. The survey included 1,042 institutional investors in the U.S. (406), Europe (370) and Asia (266), including financial advisors, family offices, crypto hedge and venture funds, traditional hedge funds, high-net-worth investors, pensions and defined benefit plans, and endowments and foundations.

Some 65% of institutional investors plan to buy or invest in digital assets in the future, according to a recent survey3, and more than one-quarter feel their perception of digital assets changed positively over the past year.

As digital asset exchanges are usually opened 24/7, direct holding has the advantage of offering better reactivity in case of market movements, allowing the initiation of transactions at all times. For example, this also provides the possibility to set stop-loss orders triggering to sell the position in case of falling prices. Depending on the token and the exchange, the liquidity can be quite good. If the custody is performed by a bank, a securities firm, or a DLT trading infrastructure, the investor may expect an institutional-grade infrastructure that avoids operational risks to a minimum.

The blind survey was executed in association with Fidelity Consulting Strategic Insights on behalf of Fidelity Digital AssetsSM and the Fidelity Center for Applied TechnologySM between May 30, 2023 and October 6, 2023. The survey included 1,042 institutional investors in the U.S. (406), Europe (370) and Asia (266), including financial advisors, family offices, crypto hedge and venture funds, traditional hedge funds, high-net-worth investors, pensions and defined benefit plans, and endowments and foundations.

Some 65% of institutional investors plan to buy or invest in digital assets in the future, according to a recent survey3, and more than one-quarter feel their perception of digital assets changed positively over the past year.